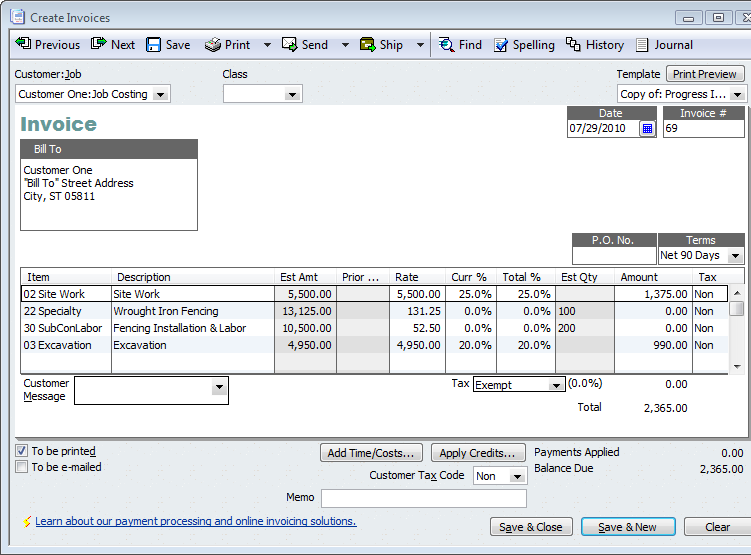

This lets you control exactly how much is billed out, though I appreciate it is a manual process. An example is:Īdd a new line for "Less 90% not due until November 2013" -$9000

Do not tick the box "Delete Quotes upon Changing to and Recording as an Order or Invoice "Ģ) When you convert the quote, add another line to the end of the invoice:Īnd subtract the corresponding amount from the total amount on that line.

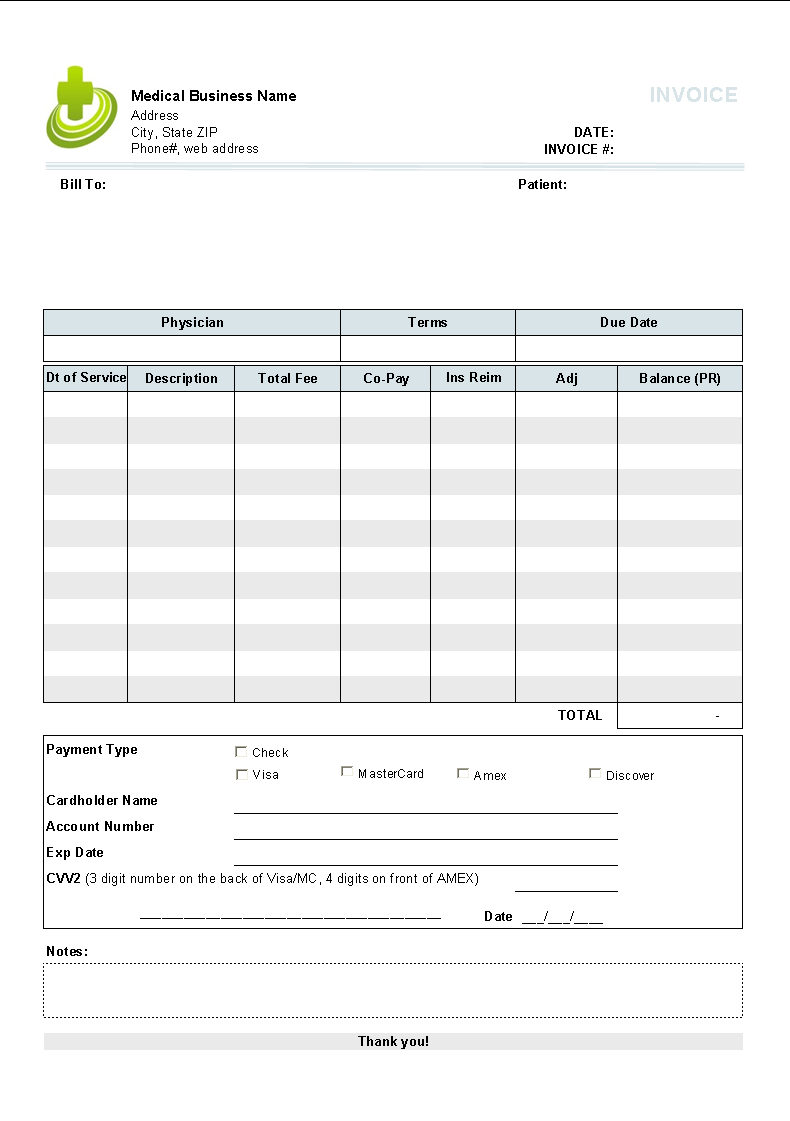

+ for His £700 invoice was settled immediately in cash. We will then send you an invoice for the total course fees. Regarding charging just a partial amount for a Quote converting to an Invoice, I recommend a process such as:ġ) Make sure the preferences are set to keep quotes when you convert to Invoices: substantivo contável An invoice is a document that lists goods that have been supplied or services that have been done, and says how much money you owe for them. to list ( merchandise sold) on an invoice Collins English Dictionary. to present (a customer) with an invoice b. Australia’s Progressive e-Invoicing Implementation J0 Type: Legislation Since 2018, the Australian Government has been implementing e-Invoicing with the support of the PEPPOL network, effectively enabling public and private entities to exchange invoices electronically. This allows you to enter more information, without having a $0 line appear, so that you can show additional information to a client/customer. a document issued by a seller to a buyer listing the goods or services supplied and stating the sum of money due verb 2. Right clicking and choosing "Insert Blank Line" There is a limit to the amount of text that can be entered into a single description in AccountRight, however we do have methods to add additional lines.

#PROGRESSIVE INVOICING FULL#

Learn more on the Australian Taxation Office’s website here.I'm from the client support team, and I thought I'd offer what guidance I could for your issues, though I'll leave your idea in the Ideas Exchange so the Developers can provide full commentary on including these features at a later point.

#PROGRESSIVE INVOICING PROFESSIONAL#

Continuing Professional Development – for Lawyers.Its a strategy for managing cash flow and. Equal Employment & Opportunity Policy (EEO) A method of billing clients that aims to expedite cash collection throughout a project is called progress invoicing.GDPR (General Data Protection Regulation).Sale of Business / Purchase of Business.Trade Mark Monitoring or Watching Service.

0 kommentar(er)

0 kommentar(er)